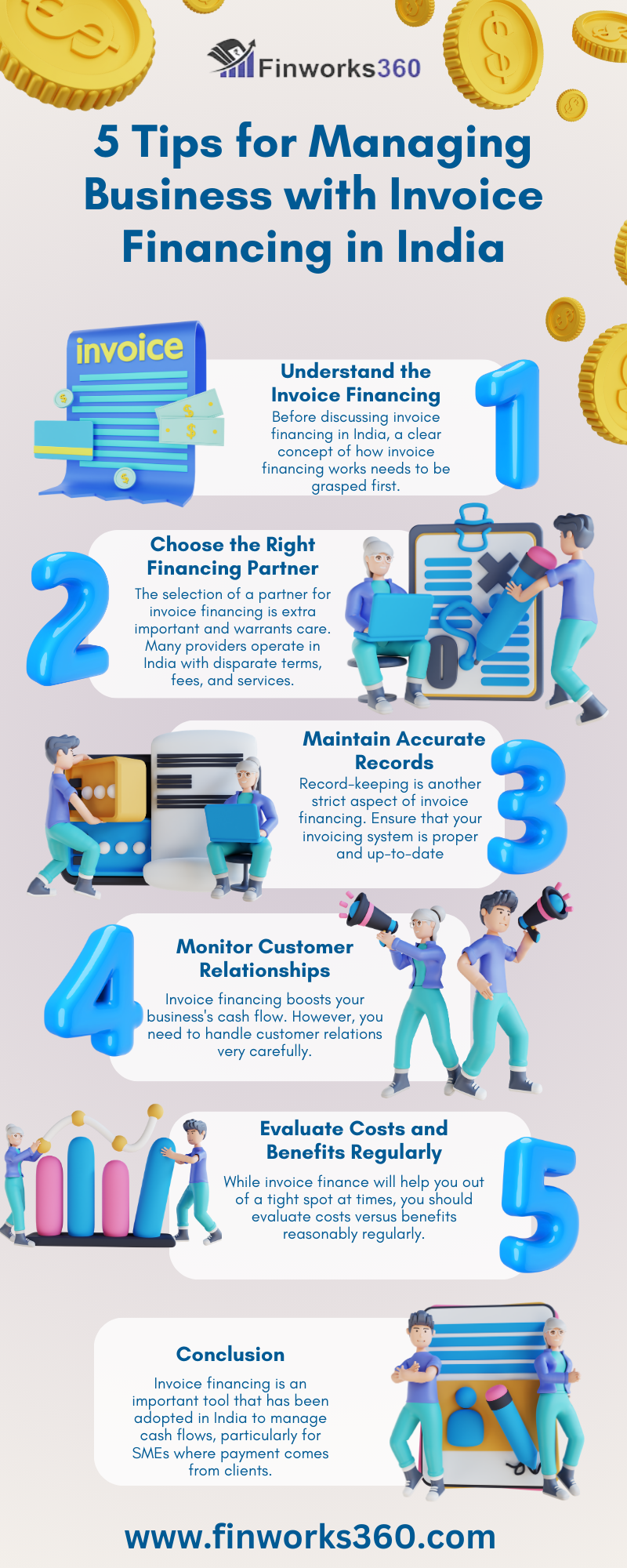

In the changing Indian business scenario, steady cash flow is one of the best growths and reasons for sustainability. Receivable financing, or invoice financing, has been rightly used by most small and medium-sized enterprises looking to fill the gap between invoicing and realizing receipts. Here are five indispensable tips for successful management with invoice financing in India.

1. Understand the Basics of Invoice Financing

Before discussing invoice financing in India, a clear concept of how invoice financing works needs to be grasped first. This financial solution enables businesses to raise instant cash by selling their outstanding invoices to a third party, typically the banking institution or the fintech companies. It pays a percentage of the invoice value upfront, up to 90%. The lender deducts his commission and transmits the rest to you when the customer pays the invoice. And you now know that the process will empower you to make some informed decisions.

2. Choose the Right Financing Partner

The selection of a partner for invoice financing is extra important and warrants care. Many providers operate in India with disparate terms, fees, and services. Explore financial institutions and fintech companies for comparison purposes. A provider with transparent pricing and quick turnaround times is desired, along with an excellent reputation in the marketplace. Furthermore, seek a provider with quality customer service and support because that is the companion that can greatly alleviate the hassle of the finance process. Always read reviews, and before choosing such a financing partner, ask other business owners for recommendations to ensure you’ve made the right choice.

3. Maintain Accurate Records

Record-keeping is another strict aspect of invoice financing. Ensure that your invoicing system is proper and up-to-date because lenders will be asking for information from your invoices down to their payment terms and clients’ status. Accurate records do not only smooth financing transactions but also enhance your ability to track outstanding invoices and manage customer relationships. Implement accounting software or tools that assist in streamlining this process and give you real-time visibility into receivables.

4. Monitor Customer Relationships

Invoice financing boosts the cash flow of your business. However, you need to handle customer relations very keenly. Proper communication with your clients will guarantee payment at the right time. Before sending reminders about the payments by your customers that are due, be so prompt in reminding them of their due payments, not as a threat but in all professional undertakings. You may remind them and treat them to an early payment discount or favourable terms of payment. Remember that maintaining an excellent relationship with your clients will bring repeat business, which is critical to your long-term prosperity.

5. Evaluate Costs and Benefits Regularly

While invoice finance will help you out of a tight spot at times, you should evaluate costs versus benefits reasonably regularly. You will incur fees on all financing arrangements. Fees range from extremely cheap to extortionate depending on who the provider is. Decide whether the benefit of speed outweighs cash generation with your use of invoice finance. Monitor and check cash position regularly, and compare with other financing options. If the cash flow improves, you may not need invoice financing, hence holding on to more profits for the long haul.

Conclusion

Invoice financing is an important tool that has been adopted in India to manage cash flows, particularly for SMEs where payment comes from clients. This basic understanding of the concept can be used by determining the right partner, proper account maintenance, monitoring the customer relationship, and details of costs involved. It might make a business use invoice financing to make its operating processes more efficient and have more growth potential. In a highly burgeoning Indian market, continuous information flow with flexibility will prove beneficial in the trying times for your business. Welcome the profitable opportunities that invoice financing has in store for you by taking charge of your future and creating your finances.